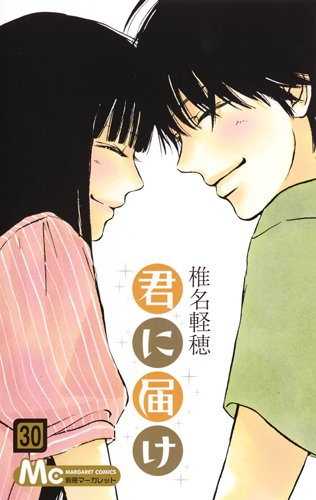

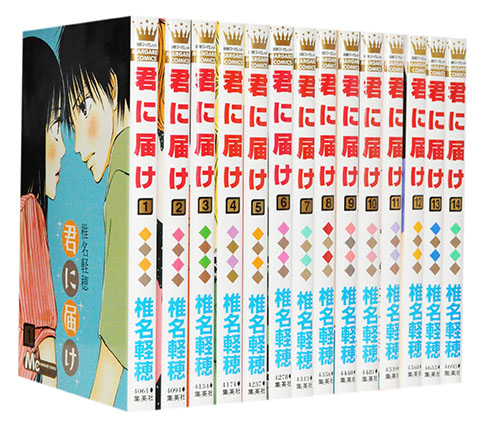

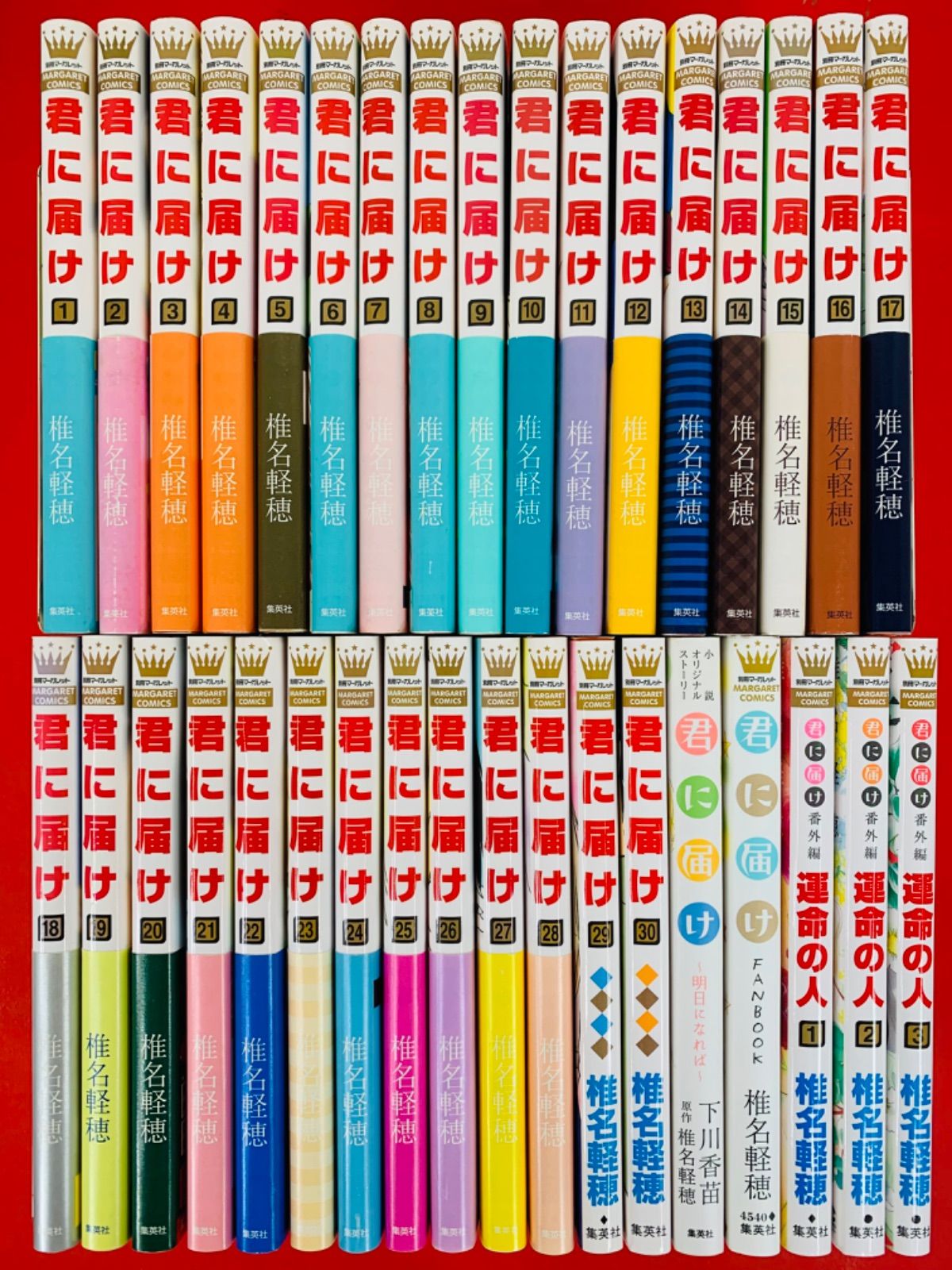

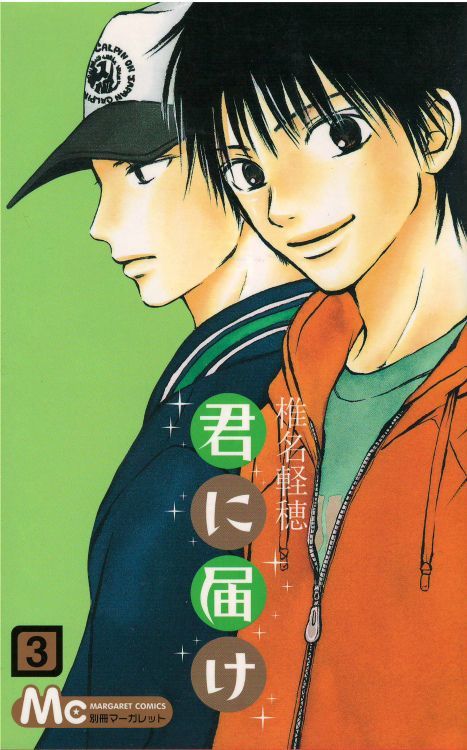

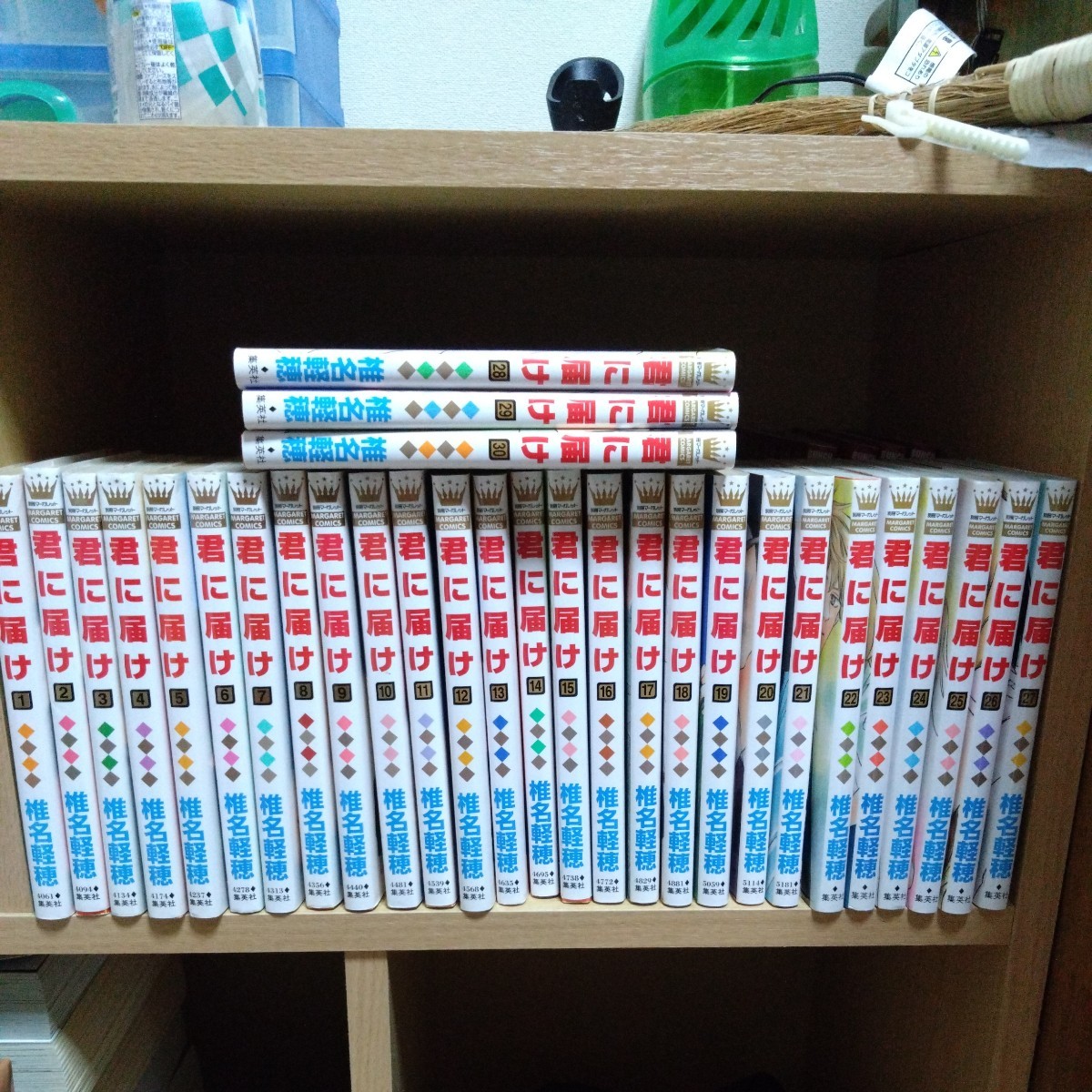

君に届け 全巻 1〜30

(税込) 送料込み

商品の説明

ご覧いただきありがとうございます。

こちらは全巻セットです。バラ売り不可。

コメントなしで即購入OKです。

本棚整理のため、出品致しました。

中古品であることをご理解頂いた上での

ご購入をお願い致します。

神経質な方は、ご遠慮ください。

ご不明点があればコメントよろしくお願いいたします。商品の情報

| カテゴリー | 本・雑誌・漫画 > 漫画 > 少女漫画 |

|---|---|

| 商品の状態 | 目立った傷や汚れなし |

君に届け 1〜30巻 全巻セット - 少女漫画

君に届け(1-30巻 全巻) | 漫画全巻ドットコム

【漫画全巻セット】【中古】君に届け <1~30巻完結> 椎名軽穂 | もったいない本舗 楽天市場店

君に届け 1-30巻 全巻セット - 少女漫画

君に届け 全巻 1~30巻 +関連本 2冊 - 少女漫画

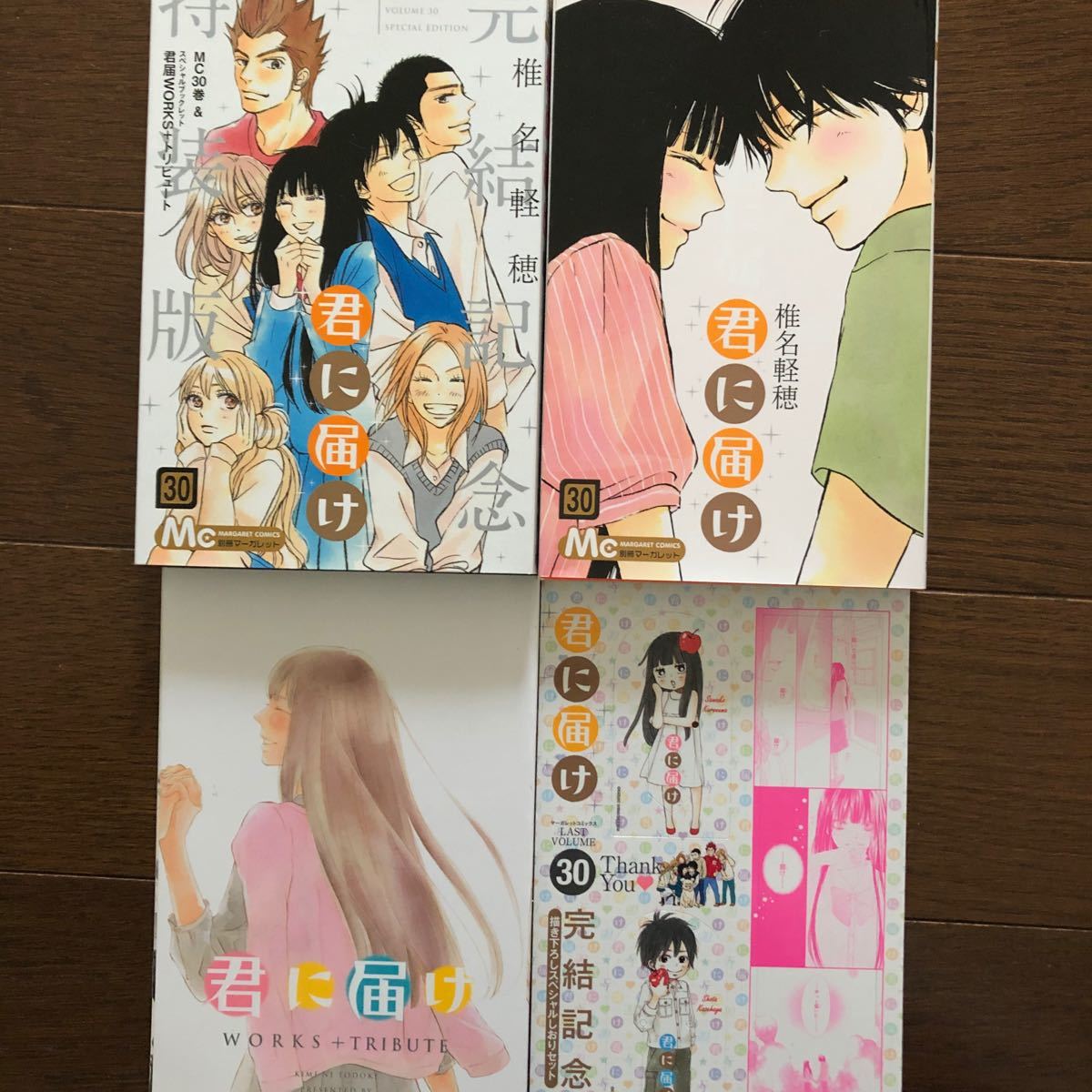

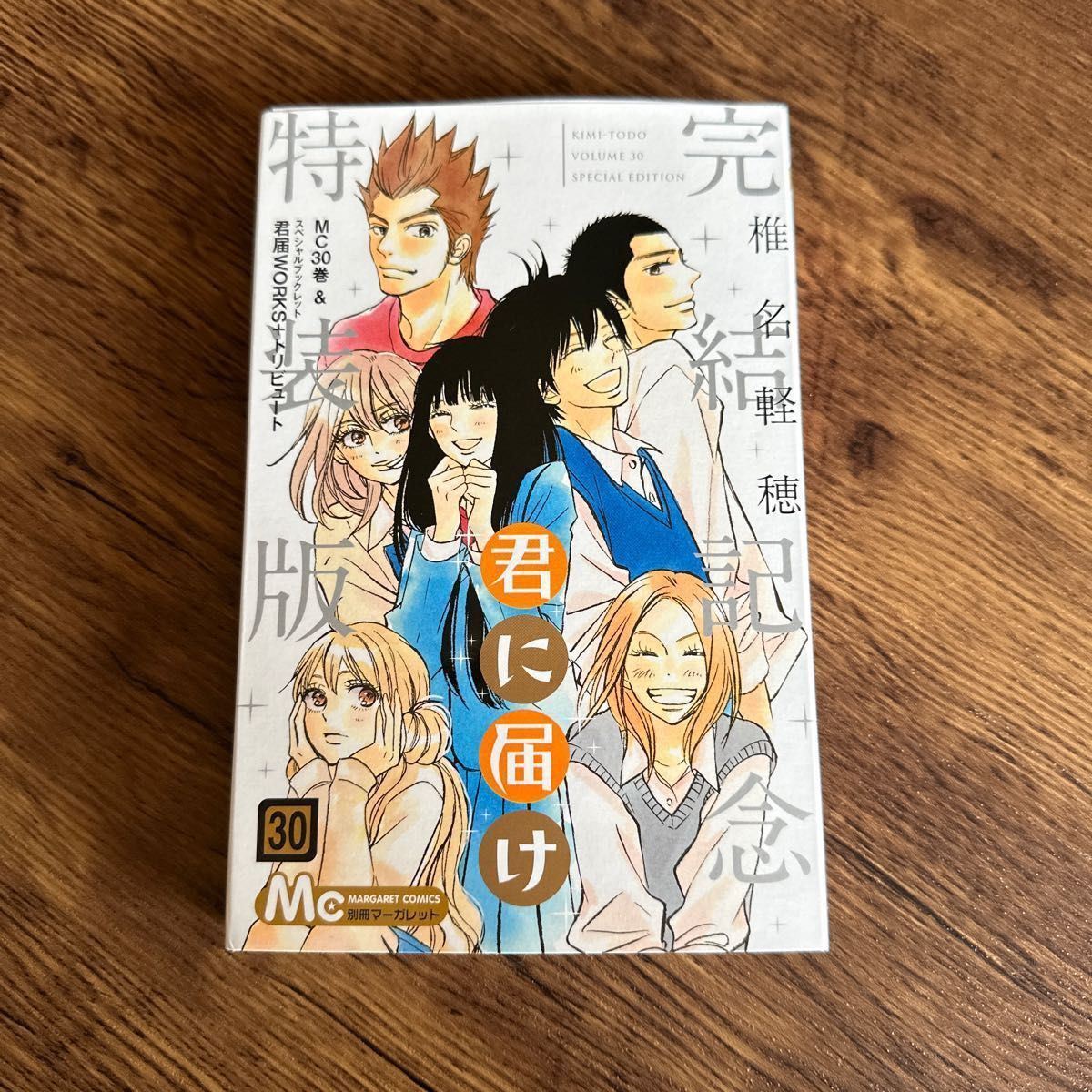

専用 君に届け 全巻 1巻〜30巻 30巻は特装版 - 少女漫画

君に届け 漫画全巻1-30 - 少女漫画

君に届け 1-30巻

君に届け 全巻 1-30巻 + 運命の人 1-3巻 椎名軽穂 完結記念特装

君に届け1-30巻+番外編1-3巻+小説・ファンブック・全巻完結

君に届け 全巻 1~30巻 &ファンブック - 少女漫画

君に届け全巻 1〜30巻

君に届け 漫画 全巻 1〜30巻 ファンブック セット - 少女漫画

君に届け 漫画 全巻 1-30+特装版 - 全巻セット

君に届け1-30巻+番外編1-3巻+小説・ファンブック・全巻完結

Amazon.co.jp: 【コミック】君に届け(全30巻) : 本

全巻+α】「君に届け」1~30(特装版)巻 + 関連本3冊-

君に届け 漫画 全巻 1-30+特装版 - 全巻セット

君に届け 1-30巻 全巻セット(完結記念特装版) - 少女漫画

Amazon.co.jp: 君に届け 1〜30巻 全巻セット : 文房具・オフィス用品

君に届け 全巻セット 1〜30巻 - 少女漫画

君に届け 漫画 全巻 1-30+特装版 - 全巻セット

販売値下げ 君に届け 漫画 全巻 1〜30巻 初版 帯付き 特装版

激安セール 【全巻+α】「君に届け」1~30(特装版)巻 君に届け +

君に届け 』1〜30巻 番外編『運命の人』1〜3巻 全巻セット

君に届け 全30巻(30巻は完結記念特装版)+小説版+DVD初回生産

新作モデル 君に届け ⭐️君に届け 1〜30巻全巻セット grand-max.jp

君に届け コミックセットの古本購入は漫画全巻専門店の通販で!

君に届け 漫画 全巻 1-30+特装版 - 全巻セット

Yahoo!オークション - 1円スタート 君に届け 全30巻 全巻セット

最新アイテムを海外通販 君に届け 全巻 1〜30巻 | hdokp.pk

売れ筋新商品 君に届け 全巻 1〜30巻 1巻 漫画 www.iccink.com

楽天ブックス: 【全巻セット】君に届け 1-30巻セット - 椎名軽穂

コミック】君に届け(全30巻)セット | ブックオフ公式オンライン

君に届け 1〜30巻 全巻セット

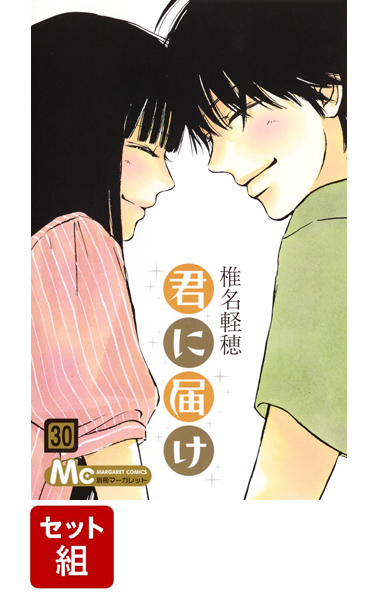

Amazon.co.jp: 君に届け 30 (マーガレットコミックス) : 椎名

良品多数❗️送料無料❗️君に届け全巻 1〜30巻 椎名軽穂 by

お取引 君に届け(1〜30)全巻セット | www.kitchellence.com

君に届け 漫画全巻1-30 - 少女漫画

春夏の新作入荷 君に届け 全巻 1〜30巻 - 漫画

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています